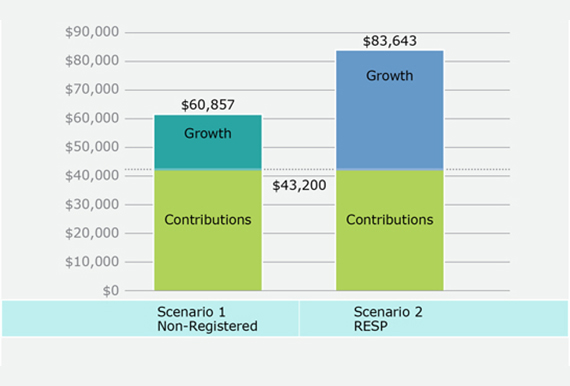

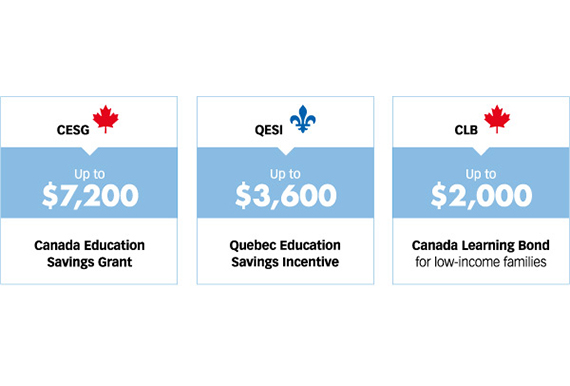

A beneficiary with a Registered Education Savings Plan (RESP) may be eligible for the Canada Learning Bond (CLB) and the Canada Education Savings Grant (CESG). There are also provincial benefits available to eligible beneficiaries in British Columbia and Québec.

The CESG can provide up to a lifetime maximum of $7,200 to an RESP

The CLB can provide up to a lifetime maximum of $2,000 for each eligible child from families with low income.

If the beneficiary is eligible to receive the Canada Learning Bond (CLB), they could receive $500 the first year, and then another $100 each eligible year after that until the age of 15, up to a lifetime maximum of $2,000 in their RESPs.

To receive the CESG, contributions must be made to the RESP. The CESG adds an amount to the RESP based on contributions made. If eligible, beneficiaries can receive up to 20% of the first $2,500 contributed to the RESP. Eligible beneficiaries from families with middle- and low-income can receive an additional 10% or 20% of the first $500 contributed to the RESP.

CESG amounts accumulate and can carry-forward to the current year. If you don’t receive the maximum CESG amount in a given year, you can still receive it in future years. You can catch up on this amount by making more contributions to the RESP.

.jpg)

The CESG is available until the end of the calendar year that a child turns 17. A contribution must be made to the RESP to receive the CESG.

There are eligibility restrictions for children who are 16 or 17 years old .

You have 60 days after signing your contract to cancel plans provided by scholarship plan dealers without any penalty. Be sure to read and understand the rules outlined in the short Plan Summary provided in the plan prospectus.

Best Insurance Advice © | All Rights Reserved. Powered by Akshari Solutions